rhode island state tax rate

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. Rhode Island has a.

Welcome Ri Division Of Taxation

Take the Assessed Value of the property then multiply.

. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Rhode Island Income Tax Rate 2022 - 2023.

Exemptions to the Rhode Island sales tax will vary by state. State of Rhode Island Division of Municipal Finance Department of Revenue. Current and past tax year RI Tax Brackets Rates and Income Ranges.

Rhode Island also has a 700 percent corporate income tax rate. Rhode Island Property Tax Breaks for Retirees. In 2011 Rhode Islands tax system underwent the most sweeping changes since the state tax was enacted in 1971.

The formula to calculate Rhode Island Property Taxes is Assessed Value x Property Tax Rate1000 Rhode Island Property Tax. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income. Rhode Island Tax Structure.

34 cents per gallon of regular gasoline and diesel. The estate tax threshold for Rhode Island is 1648611. 153 average effective rate.

In Rhode Island the median property tax rate is 1571 per 100000 of assessed home value. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375. Rhode Island State Married Filing Jointly Filer Tax Rates Thresholds and Settings.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum. The Rhode Island State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Rhode Island State Tax Calculator. Information on how to only file a Rhode Island State Income Return.

Less than 100000 use the Rhode Island Tax Table located on pages T-2. The Rhode Island tax is based on federal adjusted gross income subject to modification. If your estate is worth less than that you owe nothing to the state of Rhode Island.

The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax. Rhode Island Tax Brackets Rates explained. The current tax forms and tables should be consulted for the current rate.

For the 2022 tax year homeowners. Your average tax rate is 1198 and your. The tax rates are progressive ranging from 375 to about.

Like most other states in the Northeast Rhode Island has both a. Most notable was the reduction of the top tax rate from 99 to. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent.

Rhode Island income taxes are about average when compared to the rest of the country. To calculate the Rhode Island taxable income the statute starts with Federal. If it is worth more than that there is a.

Rhode Island Income Tax Calculator 2021. About Toggle child menu. Rhode Island State Personal Income Tax Rates and Thresholds in 2022.

Rhode Island Retirement Taxes And Economic Factors To Consider

Revenue For Rhode Island Coalition Seeks To Raise Taxes On The Richest One Percent

Rhode Island Tax Brackets And Rates 2022 Tax Rate Info

Rhode Island Sales Tax Small Business Guide Truic

Rhode Island Income Tax Calculator Smartasset

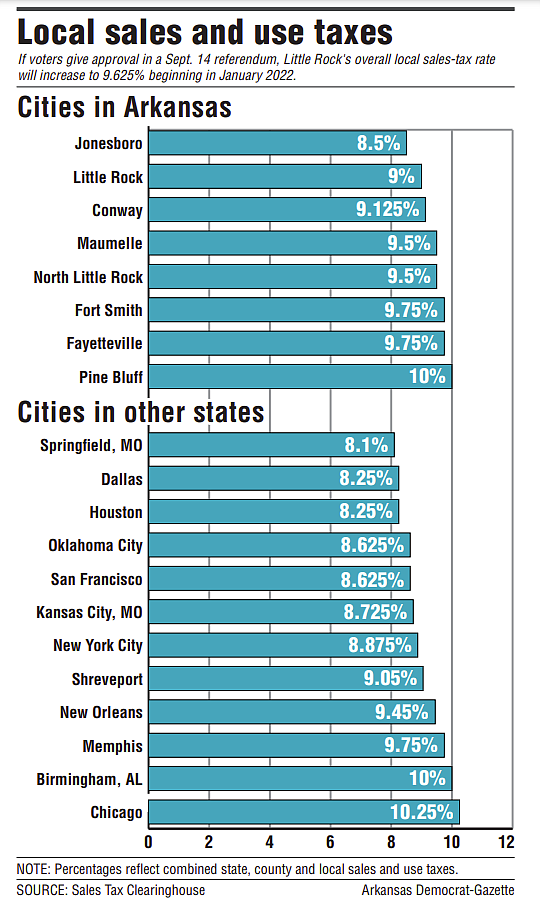

As Tax Rates Go Arkansas At Top

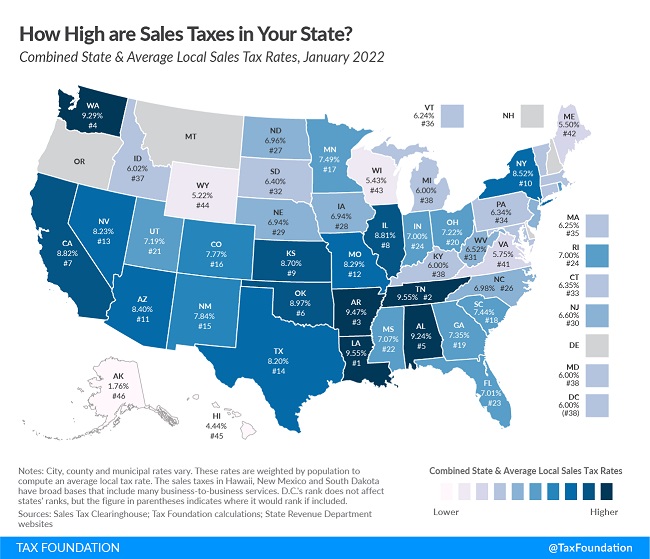

R I Ranks No 24 For Highest State Sales Tax

Solved I M Being Asked For Prior Year Rhode Island Tax And It Says Enter Your 2019 Rhode Island Tax What Does This Mean Is This Asking For My 2019 Refund

Seven Things To Know About The R I House Finance Budget The Boston Globe

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Ranked 45 Out Of 50 On Business Tax Climate Index Wpro

Tax Assessor City Of Pawtucket

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Rhode Island Property Tax Calculator Smartasset

Lists Rhode Island Property Tax Rates

Ri Kpi Briefing For Q2 2022 Rhode Island Experiences Employment Gains But Still Lags Nation In Recovery Of Jobs Lost During Pandemic Rhode Island Public Expenditure Council